Sales has evolved as a process from Solution selling to Insight selling. Customers are more and more aware of solutions that they wish to elicit from a product or service. Hence, need of the hour for an adept salesperson is making intelligent sale or a profitable sales rather than cold-calling, scatter shooting and darting in the dark.

Sales has evolved as a process from Solution selling to Insight selling. Customers are more and more aware of solutions that they wish to elicit from a product or service. Hence, need of the hour for an adept salesperson is making intelligent sale or a profitable sales rather than cold-calling, scatter shooting and darting in the dark.

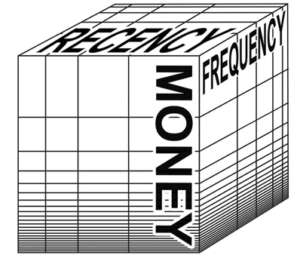

RFC (Recency-Frequency-Currency/Money) is one such Intelligent Sale approach that talks about who you pay attention to in your business, based on who is paying attention to you. You pour more and more energy into an account that is already working; less and less into what is not working.

Below are the 3 dimensions that help you sift through your accounts based on when-last, how-often and how-much have they invested in your offering.

Recency: ‘When last?’

- How recently has your customer purchased from you?

- Which customers have bought something, say, in the last 90 days?

The duration may vary from industry to industry depending on the length of a sale cycle

Frequency: ‘How often?’… Most important dimension to making Profitable Sales

- How often has your customer purchased from you?

- Which customers have repeatedly bought things from you?

This is the most important criteria of the 3 dimensions because it shows how pleased is a customer with your offering to indebt you with her repeat business

Currency (Money): ‘How big?’

- How much has your customer spent?

- Which customers have spent the most with you?

RFC is a 3-dimensional matrix where each account/ customer represents a combination of R, F, and C that help you focus your limited resources on a relatively small fraction of key customers and get hugely disproportionate returns.

The customers are weighted or ranked from most recent to the least; from most frequent to least, and from those spending the most money to least.

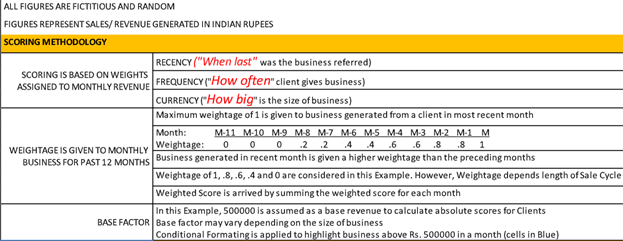

How to score clients based on RFC Model

All clients are not the same and hence they should not be treated as the same.

That means all clients should not be given equal attention (=weight) after initial prospection and qualification. and that is where the concept of Weighted Score using RFC model comes into play.

Weighted score is a criterion of assigning relative importance to clients based on their actual business performance

- Scoring is based on weights assigned to revenue generated from clients in past months. Preferably, month-wise trends of revenue should be considered for calculating the score.

- Maximum weight of 1 is given to business generated from a client in the most recent month. The business generated in recent month is given a higher weight than the preceding months

- Weightage of 1, .8, .6, .4 and 0 are considered in the sample example shared below. However, the weight depends on the length of a Sale Cycle and may vary from industry to industry.

- Weighted Score is arrived by summing the weighted score for each month

Click on the image below to download a SAMPLE SCORING SHEET based on RFC model to get you running with RFC (or RFM) concept.

NOTE: Scoring criteria in RFC is subjective and lends you the freedom to assign your own cut-off score to a client, below which you would not invest much time in them. On the other hand, you would make a brick wall around clients that score higher than cut-off.

This approach would help you sift the dust (non-buying customers) to get the gold (key buying accounts).

Armed with in-depth knowledge of their requirements and precise solutions that they seek, today’s customers are well ahead in the sales cycle these days than ever. They look not for solutions (which in most instances they are aware of) and neither do they seek lame RFQs but rather seek insights and ideas that have a tendency to give out-of-the-box perspective to a problem.

Hey, Thanks for making it this far!

If you’ve got a question or an opinion on this post, please leave your comments below.

2 Responses

I truly appreciate this forum topic.Really looking forward to read more. Really Great. Hoe

Hi William. I am glad you liked the topic. If you wish to read more such captivating articles, I would be pleased if you subscribe our Marketer’s Club by clicking the link below: https://braintannica.com/blog/subscribe/

Thanks for your feedback!

Sanket